While we haven’t yet said goodbye to 2023, it’s not too early to begin thinking about any tax changes that may be on the horizon.

The Tax Cuts and Jobs Act (TCJA) of 2017 was designed to overhaul the federal tax code by reforming individual and business taxes. As a result, sweeping tax changes lowered marginal tax rates and the cost of capital.

Although some of these provisions are permanent, most of the individual tax changes are not. Unless Congress acts, many of the changes implemented are scheduled to “sunset” on December 31, 2025. At that time, rates will revert to pre-2017 levels.

Knowing what changes may be coming and preparing for this new reality may be a good first step. There may be actions you can take to prepare for what may happen next.

Here’s a brief summary of the TCJA-related changes that are expected for each quarter leading up to the 2025 sunset of the TCJA.

Keep in mind that this article is for informational purposes only and is not intended as a replacement for real-life advice. Be sure to consult your tax, legal, or accounting professional before modifying your strategy in anticipation of TCJA-related adjustments. Remember: tax laws are constantly changing, and there is no guarantee that all the provisions of the TCJA will expire.

Overview of the Tax Cuts and Jobs Act in 2017

When the TCJA was passed in 2017, it lowered most individual income tax rates—including the top marginal rate—from 39.6 percent to 37 percent. The law maintained the preexisting seven-bracket rate structure, but income thresholds were updated. The TCJA also increased the standard deduction to $12,400 for single filers and to $24,800 for married filers versus $6,500 (single) and $9,550 (married) under the prior code.

To offset some of the associated costs, the TCJA eliminated the personal exemption and various other miscellaneous deductions and limited certain itemized deductions, like the state and local tax (SALT) deduction. The TCJA also increased the Child Tax Credit (CTC) from $1,000 to $2,000—the first $1,400 of which was refundable—and raised the associated income threshold from $110,000 to $400,000.1

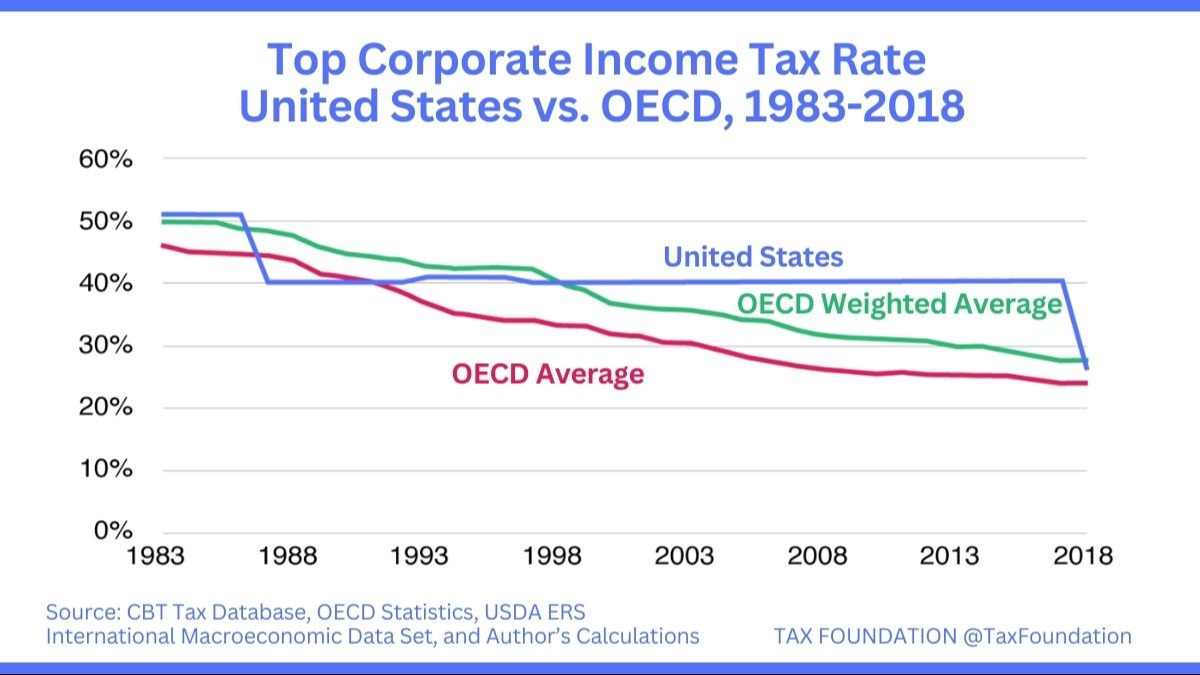

The TCJA lowered the corporate income tax (CIT) rate for businesses from 35 percent to 21 percent starting in 2018. The measure also allowed for the full and immediate expensing of short-lived capital investments for five years and increased the Section 179 expensing cap from $500,000 to $1 million. Furthermore, the bill eliminated or curtailed a variety of business taxes and expenditures, including the deductibility of net interest, net operating loss carrybacks and carryforwards, and the corporate alternative minimum tax (AMT).1

What’s Scheduled to Change for Individuals

Tax Rates

The reduction in tax rates for individuals and married couples in 2017 may increase back to where they were in 2016. That means that after December 31, 2025:

- The 37% rate is scheduled to revert to 39.6%

- The 24% rate is scheduled to revert to 28%

- The 22% rate is scheduled to revert to 25%

- The 12% rate is scheduled to revert to 15%

Tax Brackets

The tax brackets you fall into based on your income may also go back to the broader ranges that were in effect before the TCJA. Below is a visual of how much tax brackets changed in 2018 for married filing jointly filers and an estimate of their reversion in 2026.

Estate & Gift Tax Exemption

Under the TCJA, the federal lifetime estate and gift tax exclusion increased from $12.06 million in 2022 to $12.92 million in 2023. Inflation could also increase it in 2024 and 2025. However, these higher levels are only temporary. After 2025, the exclusion will sunset to its pre-2017 level of $5 million, adjusted for inflation.2

Standard Deduction & Personal Exemptions

The TCJA eliminated the personal exemption ($4,050) and doubled standard deductions, adjusted annually for inflation. The standard deduction for single filers increased from $6,350 to $12,000, and married filing jointly from $12,700 to $24,000. This resulted in fewer itemizers. After peaking in 2025, the standard deduction will be cut in half, potentially making itemizing more common again.

Qualified Business Income

One of the most substantial changes introduced by the TCJA was the qualified business income deduction—allowing up to a 20% deduction on business income for pass-through entities, trusts, and estates. Under certain AGI thresholds, taxpayers qualify; otherwise, the deduction phases out. If not extended, this provision will expire after 2025.

Alternative Minimum Tax (AMT)

The AMT had a significant makeover, raising exemptions and phase-outs, dramatically reducing the number of taxpayers impacted. However, these relief measures will expire with the TCJA.

Keeping You on Track

Preparing your taxes can be complex, and errors happen easily. By planning, staying informed, and collaborating with your tax pro, you can be in a better position as the TCJA sunsets. Remember: even when working with professionals, you are responsible for properly filing your financial information.

If you have any questions about your financial life, we’re here to help you navigate this evolving landscape as the TCJA expires. We always welcome collaborating with your tax professionals to align strategies across your financial priorities.

1 TaxFoundation.org, August 30, 2023

2 ThinkAdvisor.com, August 30, 2023